All Categories

Featured

Table of Contents

Keep in mind, nevertheless, that this doesn't say anything about readjusting for inflation. On the plus side, also if you assume your choice would be to invest in the stock exchange for those 7 years, which you would certainly obtain a 10 percent yearly return (which is much from specific, specifically in the coming decade), this $8208 a year would certainly be more than 4 percent of the resulting nominal supply value.

Example of a single-premium deferred annuity (with a 25-year deferment), with four repayment alternatives. The month-to-month payout here is greatest for the "joint-life-only" alternative, at $1258 (164 percent greater than with the immediate annuity).

The means you get the annuity will determine the answer to that concern. If you acquire an annuity with pre-tax bucks, your costs lowers your taxed income for that year. According to , acquiring an annuity inside a Roth plan results in tax-free settlements.

Who has the best customer service for Fixed-term Annuities?

The consultant's primary step was to establish a thorough economic strategy for you, and after that clarify (a) just how the recommended annuity matches your general strategy, (b) what choices s/he thought about, and (c) how such alternatives would certainly or would not have caused lower or greater settlement for the expert, and (d) why the annuity is the premium selection for you. - Retirement income from annuities

Of program, an advisor may try pushing annuities also if they're not the most effective fit for your scenario and goals. The reason might be as benign as it is the only item they market, so they drop victim to the typical, "If all you have in your tool kit is a hammer, rather quickly whatever begins looking like a nail." While the consultant in this situation may not be dishonest, it raises the threat that an annuity is a poor option for you.

Who offers flexible Guaranteed Income Annuities policies?

Considering that annuities commonly pay the agent marketing them much higher compensations than what s/he would certainly receive for spending your money in mutual funds - Annuity accumulation phase, let alone the no commissions s/he 'd obtain if you invest in no-load common funds, there is a big incentive for representatives to push annuities, and the a lot more challenging the better ()

A dishonest consultant suggests rolling that amount right into brand-new "better" funds that simply occur to carry a 4 percent sales lots. Consent to this, and the consultant pockets $20,000 of your $500,000, and the funds aren't most likely to perform far better (unless you chose much more improperly to start with). In the exact same example, the consultant can steer you to acquire a complex annuity with that $500,000, one that pays him or her an 8 percent commission.

The expert hasn't figured out exactly how annuity repayments will be exhausted. The advisor hasn't disclosed his/her payment and/or the fees you'll be charged and/or hasn't revealed you the influence of those on your ultimate settlements, and/or the compensation and/or fees are unacceptably high.

Your family members background and existing health indicate a lower-than-average life span (Senior annuities). Current rates of interest, and therefore projected payments, are traditionally low. Also if an annuity is ideal for you, do your due diligence in contrasting annuities marketed by brokers vs. no-load ones marketed by the providing firm. The latter may require you to do more of your very own research, or utilize a fee-based monetary consultant that might obtain payment for sending you to the annuity company, yet may not be paid a greater payment than for various other investment options.

Who should consider buying an Tax-deferred Annuities?

The stream of month-to-month payments from Social Security is similar to those of a delayed annuity. Since annuities are volunteer, the individuals buying them usually self-select as having a longer-than-average life span.

Social Protection benefits are totally indexed to the CPI, while annuities either have no inflation protection or at a lot of offer an established percent annual increase that may or may not compensate for inflation completely. This type of motorcyclist, as with anything else that boosts the insurer's danger, needs you to pay even more for the annuity, or approve reduced repayments.

What is the best way to compare Annuity Riders plans?

Disclaimer: This article is meant for educational functions only, and should not be thought about monetary recommendations. You should get in touch with a monetary professional prior to making any type of significant economic decisions. My career has had numerous unpredictable weave. A MSc in academic physics, PhD in experimental high-energy physics, postdoc in bit detector R&D, research study placement in speculative cosmic-ray physics (including a pair of brows through to Antarctica), a short stint at a tiny design services firm sustaining NASA, complied with by beginning my very own small consulting method sustaining NASA projects and programs.

Since annuities are planned for retired life, tax obligations and fines might use. Principal Protection of Fixed Annuities. Never ever lose principal as a result of market performance as repaired annuities are not spent in the market. Even throughout market recessions, your money will certainly not be impacted and you will certainly not shed cash. Diverse Investment Options.

Immediate annuities. Deferred annuities: For those that want to grow their cash over time, but are ready to delay accessibility to the money up until retired life years.

What types of Variable Annuities are available?

Variable annuities: Offers better potential for growth by investing your cash in investment choices you choose and the ability to rebalance your profile based on your preferences and in a manner that aligns with transforming economic goals. With dealt with annuities, the business invests the funds and offers a rate of interest rate to the customer.

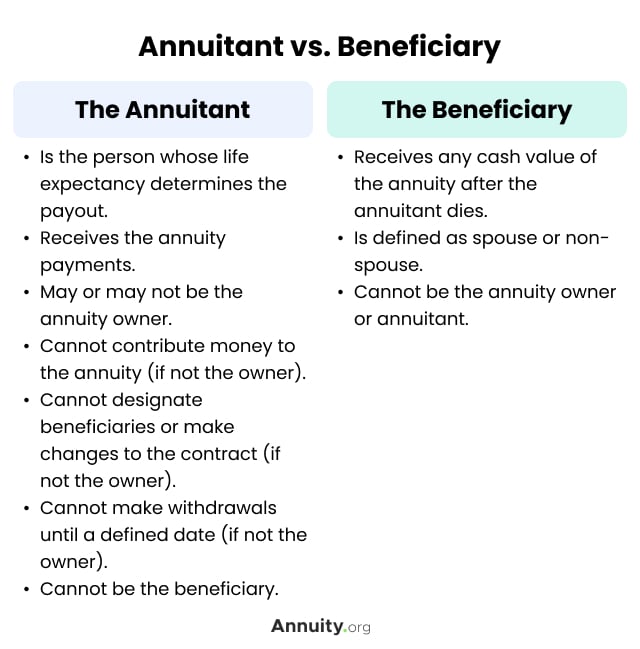

When a death claim occurs with an annuity, it is necessary to have actually a named recipient in the contract. Different options exist for annuity survivor benefit, depending upon the contract and insurance provider. Picking a reimbursement or "duration certain" option in your annuity supplies a death benefit if you die early.

Retirement Annuities

Naming a beneficiary other than the estate can aid this process go a lot more efficiently, and can help guarantee that the proceeds go to whoever the individual desired the cash to go to rather than going with probate. When existing, a fatality advantage is instantly included with your contract.

Table of Contents

Latest Posts

Breaking Down Your Investment Choices Everything You Need to Know About Financial Strategies Breaking Down the Basics of Investment Plans Features of Fixed Interest Annuity Vs Variable Investment Annu

Highlighting Tax Benefits Of Fixed Vs Variable Annuities Everything You Need to Know About Immediate Fixed Annuity Vs Variable Annuity What Is the Best Retirement Option? Advantages and Disadvantages

Understanding Fixed Annuity Vs Equity-linked Variable Annuity A Comprehensive Guide to Investment Choices Breaking Down the Basics of What Is Variable Annuity Vs Fixed Annuity Pros and Cons of Various

More

Latest Posts